What Is An Accredited Investor?

Let’s begin with the fundamentals. What does the term “accreditation” mean? An accredited investor is, broadly speaking, a person or organization that is permitted to take part in specific securities offerings.

These securities are often more sophisticated or complicated investment options, some of which may not be registered with financial regulators. By doing this, it is made sure that any investors who take part are sufficiently financially literate to comprehend and assess the risks associated with possible investments, and as a result, are not in need of the safeguards offered by a registered offering.

An accredited investor essentially has the right to “drive” on the open highway of the financial world, but they do so at their own risk.

These types of exempt securities offerings, which include many real estate syndications, are called private placements.

While some private placements can be open to non-accredited investors who have a personal connection with the investment leads, many are open to accredited investors only.

How To Tell Whether You’re Accredited

You don’t need to take a formal test to get accredited, so don’t worry. Instead, it is obtained by fulfilling specific SEC-set qualifications, either professional or financial.

You are regarded as an accredited investor if you satisfy at least one of the criteria below.

You might need to “prove” your accreditation status in order to be eligible to invest, depending on the type of private placement offering (more on this in a moment).

Income Requirement

The first prerequisite is based on income, and it’s rather simple to figure out if you meet it or not. You must meet the income criterion in order to be certified…

have a yearly salary of $200,000 (or $300,000 if you have a spouse or spousal equivalent and your income is joint)

have been earning this much for the past two years.

This year, anticipate earning the same or more money.

Woohoo, if that’s you! You fit the definition of an accredited investor. There’s no need to fulfill the other conditions. Continue reading for the following qualification if you haven’t already satisfied this income criteria.

P.S. Do you have any idea what “spousal equivalent” means? A cohabitant who occupies a relationship that is typically comparable to that of a spouse is referred to as a spousal equivalent.

Net Worth Requirement

The second need for accreditation is having a net worth of $1 million or more, not including your principal residence, either on your own or jointly with your spouse or spousal equivalent.

Let’s get a little more into this because it can be more difficult to compute.

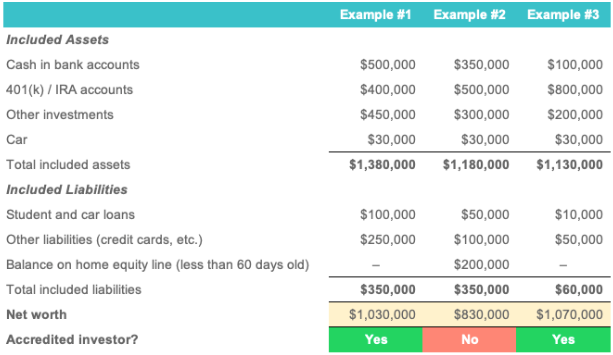

How To Calculate Your Net Worth

To start, begin by compiling an inventory of all your assets, including investments, savings, and other holdings, as well as your liabilities, encompassing loans, debts, and similar obligations.

Next, calculate the aggregate value of your cash, retirement accounts, and investments, and then deduct the outstanding balances of your student loans, car loans, and any other liabilities. The resulting sum represents your net worth.

It’s crucial to recognize that, when defining an accredited investor, the value of your primary residence should not be factored into this computation. Similarly, any mortgage or loan associated with your primary residence should not be considered a liability, as long as it remains within the fair market value of the property.”

How To Qualify As An Accredited Investor – Professional Requirements

The SEC changed the definition of accredited investors in 2020 to include additional professional requirements, such as obtaining certain financial licenses.

It’s important to keep in mind that the SEC and other regulatory agencies want to ensure that anybody making these potentially risky transactions is financially literate, which is why these professional standards are necessary.

You must be or possess one of the following in order to meet the requirements for professional accreditation:

-

Some professional licenses, qualifications, or credentials (for instance, if you possess a Series 7, 65, or 82 license)

-

Individuals who work for a private fund as “knowledgeable employees”

-

Investment advisors with SEC and state registration executives, general partners (GP), or directors of the entity selling the securities

-

Any “family client” that is accredited by a “family office”

It’s crucial to remember that individuals who meet the criteria for accreditation based on their position as competent workers are only taken into account for offers handled by their companies.

In other words, individuals cannot invest in other products using their position as an informed employee.

Can Entities Qualify As Accredited Investors?

Wonderful question. In short, the response is yes. The accreditation standards for entities, however, differ slightly from those for people.

An organization must satisfy one of the following requirements in order to be regarded as accredited:

-

Own interests of at least $5 million

-

Accredited investors make up all equity owners.

-

SEC-registered broker-dealers and investment advisors (whether state-registered, SEC-registered, or exempt reporting advisers)

-

A small business investment company, rural business investment company, bank, savings and loan association, insurance company, registered investment company, business development firm.

As you can see, establishing an organization to achieve the $1 million criteria does not just need gathering a handful of your friends who have money and adding it all together.

To be eligible, the entity’s equity owners must all be accredited investors themselves.

Accredited Investor Examples

After discussing the several ways to become certified, either as an individual or as an organization, let’s go through some instances to make sure everything is clear.

Accredited Or Not – Example #1

Felicia, welcome. Felicia is a single lady with ten years of experience in the business sector. Despite not yet making an investment, she has recently begun studying about real estate.

She just got a raise 2 months ago and now makes $200,000 per year. Felicia’s primary residence is worth $1.5 million. She has $700,000 in her 401(k) and $350,000 between her savings account and a few small brokerage accounts. She also has $100,000 left in student loans.

Is Felicia Accredited?

Felicia’s yearly income during the last two years has been below $200,000, thus despite the fact that she presently makes $200,000 and has good cause to assume she will continue making that amount or more in the upcoming year, she is ineligible due to the income requirement.

Felicia’s net worth, excluding her principal property, is the total of her assets less her obligations (amounts owing). Oh, I get it. The principal home significantly reduces the available funds, although the SEC changed this in 2010 to comply with the Dodd-Frank Act.

Given that, Felicia’s net worth comes out to $950,000, which is below the $1 million threshold.

$700,000 (retirement) + $350,000 (savings and investments) – $100,000 (student loans) = $950,000

Because Felicia meets neither requirement, Felicia is a non-accredited investor. Chin up, Felicia! There are still plenty of investment opportunities out there for you.

What Does Being An Accredited Investor Get You?

Given the effort required to reach the accreditation barrier, you should undoubtedly receive benefits like a gold-plated name card, a reservation at the most exclusive dining establishments in town, and first-class travel arrangements anywhere in the world.

Okay, good. None of those things come with accreditation alone.

But! You may take satisfaction in knowing that the SEC doesn’t need to worry too much about you because they perceive you as being financially competent. You must agree that’s something.

Why Did The Securities And Exchange Commission Create The Label Accredited Investors?

Hedge funds, start-up companies, venture capital, private equity, real estate investment funds, and angel investments are just a few examples of the riskier investments that accredited investors are permitted to make.

In order to protect non-accredited investors from the risks associated with these types of investments as well as from financial and business matters they may not be familiar with, the SEC established these regulations and federal securities laws because these types of investments are exempt from a plethora of rules and regulations.

Does that imply that you only invest in high-risk securities once you have earned accredited investor status? No, it simply means that, as an accredited investor, you have the resources and expertise to weather the storm or be able to reduce the risks associated with a private fund.

Do You Need To Verify If You Are An Accredited Investor?

There is no governmental system in place to verify your accreditation. A passport or social security card cannot be obtained in the same way.

However, the businesses you will be investing with could want to verify that you are an authorized investor by requesting certain fundamental financial documents, such as tax returns and the like.

You could occasionally be asked to supply your tax returns and/or a statement from your CPA or lawyer attesting to your accredited status, depending on how the investment is set up.

Are Accredited Investments Better Than Non-Accredited Investments?

The quick answer to this often asked question is no. Just because an investment is set up such that authorized investors are the only ones it accepts does not automatically imply that it is a better or worse investment than one that is also accessible to non-accredited investors.

The sponsor team often determines the optimal way to organize each private placement offering depending on the needs of the company, the other investors, and other factors.

Some transactions that were available to authorized and non-accredited investors have surpassed returns and pro forma by a significant margin, and vice versa. Therefore, whether an offering accepts non-accredited investors or not has no effect on the investment’s quality.

How Do Non-Accredited Investors Get Into these Great Investment Opportunities?

If you’re a non-accredited investor with a passion for real estate and a keen interest in investing in commercial real estate private placements, such as new construction or multifamily properties that contribute positively to local communities, don’t worry. There are still viable options available to you.

Rest assured that hope is not lost, as there are investment opportunities that offer comparable returns to those exclusively accessible to accredited investors. Nevertheless, it’s important to note that finding such opportunities can be more challenging for non-accredited investors, primarily because they cannot be publicly advertised due to SEC regulations.

To navigate this landscape effectively, consider seeking assistance from state-registered investment advisers. They can provide valuable guidance and support in accessing these excellent investment prospects.

Next Steps

After going through all the information we covered, it’s completely understandable if you feel overwhelmed and your head is spinning.

However, the primary objective was to assist you in determining your accredited status, and hopefully, the definitions and examples provided in this article have helped you achieve that.

Now that you have a clear understanding of whether you fall into the accredited category or not, you can proceed to explore investment opportunities that align with your goals.

At Astre Capital, we offer a range of options designed to help you learn about and invest in real estate, allowing you to leverage cash flow, equity, appreciation, and tax benefits.

Below are a few resources to help you begin your journey.

Astre Capital Investor Club: Apply Here

If you’re ready to invest or need to learn more. Join our exclusive investor club and start seeing our latest offerings today.